Key Points:

Global markets experienced a volatile week, influenced by China's stimulus measures, expectations of interest rate cuts, and geopolitical developments.

The US dollar and Treasury yields declined, while the Japanese yen appreciated following election results.

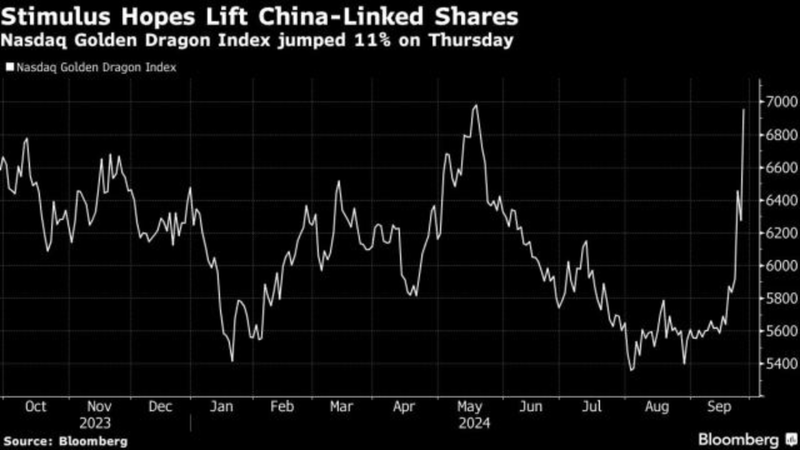

China's stimulus package enhanced investor confidence and sparked an increase in Chinese stock prices. Rising expectations for more significant interest rate reductions by the Fed and ECB bolstered risk-taking across various markets.

Geopolitical events, such as the Israeli-Palestinian conflict and the UK's leadership change, also impacted market sentiment.

A Week of Market Fluctuations

The global market landscape was marked by a series of ups and downs this week, driven by a confluence of factors. China's announcement of a stimulus package, coupled with increasing expectations for interest rate cuts by major central banks, fueled optimism and lifted stock indices. However, geopolitical tensions and economic uncertainties tempered the overall bullish sentiment.

China's Stimulus Package

China's stimulus measures, aimed at reviving the slowing economy and boosting investor confidence, had a significant impact on the market. The CSI 300 Index climbed significantly, achieving its strongest weekly performance since 2008. The government's commitment to supporting the economy and addressing underlying challenges instilled confidence among investors.

Interest Rate Expectations

Increasing speculation about more substantial interest rate cuts from the Federal Reserve and the European Central Bank has further boosted risk appetite. Investors anticipate that these central banks will continue their easing policies to support economic growth and combat inflationary pressures.

Geopolitical Developments

Geopolitical events also influenced market sentiment. The Israeli-Palestinian conflict and the UK's leadership change created uncertainty and volatility in certain sectors.

Market Performance

US Stocks: At the close of the week, US futures dipped slightly, yet the main indices still posted significant weekly increases.

European Stocks: The Stoxx Europe 600 index climbed, reflecting the positive impact of China's stimulus and rate cut expectations.

Currencies: The US dollar weakened, while the Japanese yen appreciated following election results.

Commodities: Oil prices experienced a mixed week, with prices ultimately declining on expectations of increased supply. Gold prices rose in anticipation of further interest rate cuts.

Looking Ahead

Although the market outlook seems favorable, investors ought to exercise caution and keep a close watch on ongoing developments. Economic uncertainties, geopolitical risks, and potential shifts in central bank policies could impact market sentiment. It is crucial to perform comprehensive research and take various factors into account prior to making investment choices.

Comments