Date: 12 August 2024 | Skill Level: Beginner

Osmosis is a premier cross-chain DeFi hub. It’s a proof-of-stake blockchain built upon the Cosmos SDK. The platform is built primarily to support automated market maker (AMM) applications, in this case, Osmosis decentralized exchange.

It allows investors to trade and stake cryptocurrencies with no central authority. The platform uses AMM algorithms that automatically adjust the prices of assets in the liquidity pool based on supply and demand.

The process enables traders to buy and sell assets at a fair market rate.

Here are the key features of Osmosis that sets it apart in the market are:

- Concentrated liquidity: A new AMM discovered by Uniswap lets you use your capital more efficiently.

- EIP-1559: Act as a protective layer for your blockchain and prevents attacks on the network. It does so by adjusting transaction fees dynamically based on network congestion.

- Superfluid staking: Latest Osmosis innovation that lets users provide liquid, swap, and access staking for tokens.

And many more.

In this Osmosis guide, we cover everything there is to know about Osmosis. You will learn how Osmosis was developed, the technology behind it, tokenomics, market analysis, and much more.

Background and Development

Sunny Aggarwal, Dev Ojha, and Josh Lee founded Osmosis in 2021. The project was announced in October 2020 and went live on 19th January 2021.

The goal of this project was to recreate something in line with Balancer and Sunny’s 'DAOfying Uniswap Automated Market Maker Pools,’ i.e., a completely customizable decentralized exchange (DEX).

Key Milestones

- October 2021: Osmosis closed a $21 million token sale led by Paradigm.

- February 2022: To enable building advanced DeFi protocols, CosmWasm was added to Osmosis in February 2022. Osmosis introduced Superfluid staking with the network’s carbon upgrade.

- January 2023: Concentrated Liquidity was added to the protocol.

- June 2023: Introduced an updated tokenomics model – OSMO 2.0.

- July 2023: Upgraded the platform to enhance capital efficiency by introducing supercharged liquidity, custom liquidity pools backed by CosmWasm smart contracts, and improved overall functionality.

- November 2023: Introduced a 0.1% taker fee on trades, generating a real yield for OSMO stakers.

- April 2024: Launched Alloyed Asset to tackle issues related to liquidity fragmentation and user experience.

- May 2024: Launched Osmosis smart accounts.

Technical Overview

Osmosis operates on the Cosmos blockchain (also known as the Internet of Blockchains). Cosmos has hundreds of interlinkable blockchains that can swap tokens between them; Osmosis is one of these blockchains.

All the blockchains on Cosmos are open-source, so it’s easy for developers to ship new features that they desire.

The native token of Cosmos is ATOM and is used to pay all transaction fees on the Cosmos network.

Osmosis Features

- Concentrated Liquidity

Osmosis offers a feature called Concentrated liquidity that lets liquidity providers (LP) allocate their funds in a specific price range rather than spreading them thinly across all possible prices.

Here’s a scenario for you to understand the concept better:

Let’s say there’s a liquidity pool of ETH/DAI.

Even though the price range of ETH/DAI doesn’t fluctuate significantly, LPs would have to spread their money across the entire possible price range.

But with concentrated liquidity features in place, an LP has the option to choose a narrow price range to provide their liquidity. Let’s say the LP chose a range of 1,400 - 1,900 DAI per ETH. So the capital of LP that chose this range will be concentrated only in this price range.

This approach gives you an average of 200-300x higher capital efficiency. What’s more, the approach also benefits traders due to lower price impact.

2. EIP-1559

The Osmosis EIP-1559 fee market implementation is designed to prevent spam attacks on the network. How does it do it? The implementation dynamically adjusts transaction fees based on network congestion.

3. IBC Hooks – Wasm Hooks

Wasm Hooks is an IBC middleware used to allow ICS-20 token transfers so that you can initiate contract calls.

4. IBC Rate Limit

The IBC rate limit adds a governance-configurable rate limit to IBC transfers. It’s a safety control that protects assets on Osmosis if a bug or a hack is injected into the platform, counterparty chain, or IBC itself.

Other features Osmosis offers are – Superfluid staking, token factory, and protorev.

Osmosis Tokenomics

Token Supply

Circulating supply: 676 million.

Max supply: 1 billion.

Osmosis (OSMO) Allocations

- Liquidity mining incentives: 45% of the total, which is 449,089,228 OSMO.

- Developer vesting: 25% of the total, which is 249,494,015 OSMO.

- Staking rewards: 25% of the total, which is 249,494,015 OSMO.

- Community Pool: 5% of the total, which is 49,898,803 OSMO.

Inflation and Vesting

- In June of 2023, Osmosis cut token inflation by 50% from approximately 22% to 11%.

- The Osmosis team is working to introduce a protocol revenue burn mechanism, which could further offset the remaining inflation, leading to a net deflationary model.

- Vesting schedules are in place for the developer and staking rewards allocations.

Market Analysis

Osmosis’ price as of today [12th August 2024] is $0.380 per (OSMO/USD) with a current market capitalization of $257,592,482.

24-hour trading volume: $8,032,026.

According to Coinranking, OSMO is currently ranked 183 in the entire crypto ecosystem.

Price History

- Today - 12.08.2024: The amount changed by $0.018603, which is an increase of +5.06%.

- Last 30 Days: The amount decreased by $0.120191, which is a decline of -23.75%.

- Last 60 Days: The amount decreased by $0.330046, which is a decline of -46.10%.

- Last 90 Days: The amount decreased by $0.450177, which is a decline of -53.84%.

According to CoinMarketCap, OSMO went live on 5th October 2021 at a price of $5.1209 and stayed there throughout the month.

The coins showed its first dip on 19th December and fell to a price of $4.0785.

However OSMO saw a huge spike in its price from January to early March, reaching its peak price of $11.14 on 4th March 2022.

Unfortunately, OSMO fell victim to the crypto crash and plummeted to $0.7211 on 19th June (its lowest value since its launch).

The road for OSMO has been constant since then. Since 2022, the price range OSMO has been in is quite stable – $1.2 to $1.7.

Recent Developments and News

19th July 2024: Osmosis launched Smart Accounts that enable one-click trading for users.

10th July 2024: Osmosis partners with Nomic to waive off Bitcoin (BTC) bridging fees for transactions on the Osmosis platform. This decision came following a successful DAO vote with 99.6% approval.

30th May 2024: Fireblocks, a digital asset custody platform integrated with Cosmos, via Osmosis. This helped enhance DeFi functionalities that’s available to Fireblocks users.

26th March 2024: Osmosis was identified as the DeFi project with the highest development activity level.

3rd January 2024: Osmosis hits $1.121 billion in monthly volume as interest in Cosmos surges.

4th December 2023: Osmosis merged with Umee’s cross-chain lending UX Chain to inherit its lending features, some of which are spot margin trading, shorting, liquidations, etc.

Investment Perspective

In the past few months, OSMO has seen significant volatility and market sentiment fluctuations.

The current supply of OSMO is 1 billion OSMO, while its circulating supply is 676,250,491OSMO. (Source: CoinMarketCap).

At the time of writing, OSMO’s current rate is $0.386 that’s almost similar to the value it had 24- hours ago ($0.3858), with almost no percentage change.

The trading volume of OSMO in the past 24-hours is $8,475,265. It’s down 23.84% from the last day.

OSMO Moving Averages Analysis

Moving averages help identify trends by smoothing out the pricing data. If you see the above chart, there are 2 smooth lines – 200-day exponential moving average (EMA) and 50-day EMA.

The 50-day EMA is short-term moving average, and the 200-day EMA is long-term moving average. Since the 50-day EMA is below the 200-day EMA, the prediction for OSMO is a bearish trend.

OSMO Relative Strength Index Analysis

Relative strength index (RSI) helps you measure the speed and change of trading price movement in OSMO. It measures this value on a scale of 0 to 100.

Two things to remember:

- An RSI below 30 indicates that an asset would have been undersold.

- An RSI above 70 indicates that an asset would have been overbought.

For OSMO, the current RSI is below the signal line with a value of 61.52. With this score, the trend comes out to be neutral, meaning that OSMO is neither undersold nor overbought.

Advantages and Challenges

Pros

1. Interoperability

Osmosis achieves interoperability through Inter-Blockchain Communication (IBC). It's integrated with other projects on the Cosmos blockchain, which expands its operations and enables interchain native Dapps and cross-chain transactions.

2. Decentralization

Lets you create custom liquid pools and receive rewards for providing liquidity, enabling them to trade coins and access liquidity pools for tokens from multiple blockchains built using Cosmos without requiring intermediaries.

3. Governance

OSMO token holders can directly participate in the governance decisions through voting proposals and influence decisions regarding the platform's development and operations.

For instance, a recent proposal involved adopting a "fee-free" Bitcoin bridge to enhance Bitcoin liquidity within the Osmosis ecosystem. 95% of voters were in favor of this proposal.

Cons

1. Instability

Like any other cryptocurrency, OSMO is fragile and volatile due to several factors. Market scenarios, price fluctuations, and regulatory compliance may play significant roles in the sustainability of the token and ROI for investors.

2. Vulnerability

Osmosis dependence on the Cosmos ecosystem is dicey. Considering the largest Cosmos-based project (Terra blockchain) crash in 2022, speculations regarding the vulnerability of OSMO are red-hot in the market.

Security and Trustworthiness

Osmosis has several security protocols in place to protect investors and users, such as:

- Proof-of-stake (POS) mechanism: Osmosis operates on a delegated proof-of-stake consensus mechanism to verify new cryptocurrency transactions and guarantee that data saved on the network is valid.

- Decentralized governance and community involvement: Token holders can participate and have a say in the development and security measures of the platform, ensuring that the users feel ownership and responsibility for building a robust network.

- Daily epoch releases: Osmosis users have more predictability and reduced sell pressure around the token supply schedule compared to per-block issuance. Since Osmosis releases new tokens daily at the end of each epoch, investors can easily model the token inflation rate and total supply over time.

- Bug bounty program: Osmosis's frontend bounty program incentivizes ethical hackers to identify and report vulnerabilities and bugs in its code, further enhancing the platform's security.

OSMO cryptocurrency has surpassed key audits and compliance checks from security agencies like:

In September 2023, OSMO received a security audit from the SPY WOLF crypto security agency.

How to Buy and Store

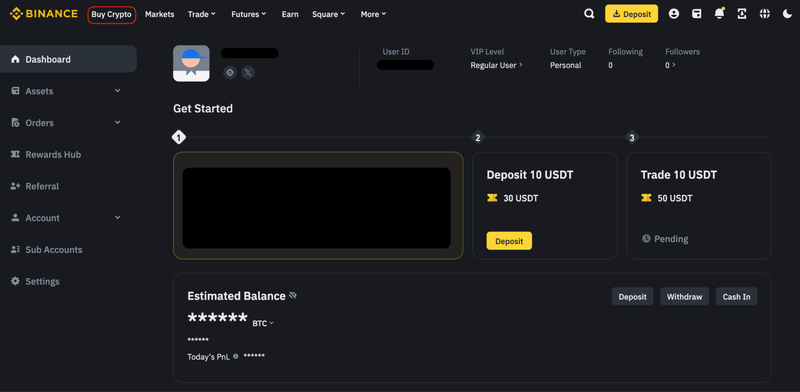

There are several ways to purchase and store OSMO coins, but in this guide we will show you how to do it with Binance.

The only prerequisite for this method is that you must have a Binance account (it’s free to create and use).

Step 1. Log into your Binance account and click ‘Buy Crypto’ you see on the top left corner.

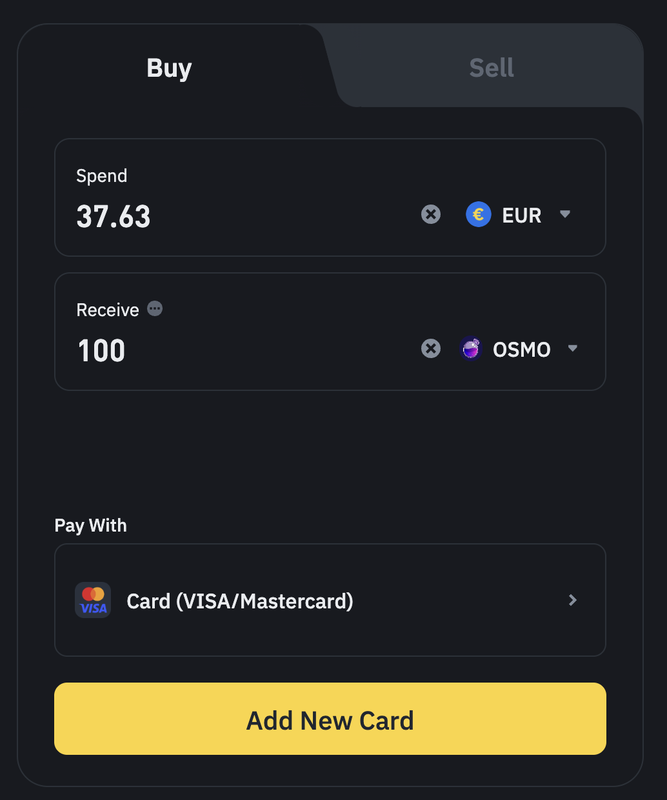

Step 2. In the Buy section, select the currency you want to pay for to buy OSMO (EUR in our case) and select ‘OSMO’ in the receive box from the cryptocurrency drop-down.

Enter the amount you’re willing to spend or the number of OSMO coins you want to buy.

Next, add your card details and simply buy OSMO coins.

Note: After you click ‘Confirm’ to buy the cryptocurrency, you will be redirected to your bank’s OTP transaction page. Follow the instructions to verify the payment.

Other preferred crypto exchanges and purchase locations to buy OSMO coins:

The five primary wallets where you can store your OSMO coins safely are:

- Keplr Wallet: This Cosmos wallet plugs you into any blockchain quickly and securely. The wallet helps you explain your votes and build relationships with your delegators.

- Leap Wallet: It’s a Cosmot wallet that helps you with IBC transfers and offers blockchain specific features for 50+ chains.

- Obvious Wallet: The multi-chain wallet lets you store OSMO coins across multiple supported chains.

- Trust Wallet: Offers features like security scanner and encrypted cloud backup to keep your OSMO secure.

- Ledger Hardware Wallet: Physical wallets like Ledger Nano S Plus and Ledger Nano X store private keys offline. Such types of wallets are one of the safest ways to store cryptocurrencies.

Future Outlook

Osmosis saw its lowest value of $0.22 on 19th October 2023. But it has also seen an all-time high of $11.21 in March of 2024.

When compared to other cryptocurrencies, the volatility of OSMO isn’t that high and that’s the main reason why its future is filled with concerns.

Some of the key factors that could influence OSMO’s future trends and values are:

- Market demand and investor sentiment: The more people use Osmosis to carry out trading, the more the value of OSMO coin, and vice versa.

- Technological advancements: Osmosis has started on the right path by introducing features like Superfluid staking, concentrated liquidity, etc., if it brings in new, out-of-the-box features with time, it has a bright future.

- Regulator environment: If the regulation changes in crypto and DeFi platforms are favorable to OSMO, the price will rise.

Summary

We hope you have now understood all about the Osmosis platform. It’s history, technical overview, market analysis, and the pros and cons.

But the main question that’s still left to answer is – Is OSMO coin worth investing in in 2024 and beyond?

After analyzing several investment data and financial metrics, we think the coin is worth investing only if you're comfortable with long-term gains. Get this, OSMO coin won’t give you short-term profits, if you invest in it, give it at least 2 to 3 years before coming to any kind of conclusions.

However, don’t take our word on it. Do your own research and then cross-verify with us if you’re on the same page.

The significant volatility and mixed market predictions need careful consideration and personal research before making investment decisions.

Comments