The future of blockchain lies in the development of digital identity, web 3.0 projects and in compelling solutions to critical problems like scalability, brutal latency, computational power, limited storage and interoperability. That sounds like a lot of crypto buzz words. And, yes, it is to common people.

The huge valuation boom that engulfed the crypto market last year is still continuing its bull run in the ICO market despite the cryptocurrency bear market. In 2018 alone, the collective funds raised in ICO is close to $6B but how much of that has translated into token adoption? How many token adopters are using the token product or platform for personal or business use cases? Have they organically shifted their loyalty/usage from the legacy systems to the crypto platform or product?

Is there a void in the token adoption market?

(The legal issues hindering mass adoption of cryptocurrencies and tokens are beyond the scope of this article.)

THE CHICKEN & EGG PROBLEM

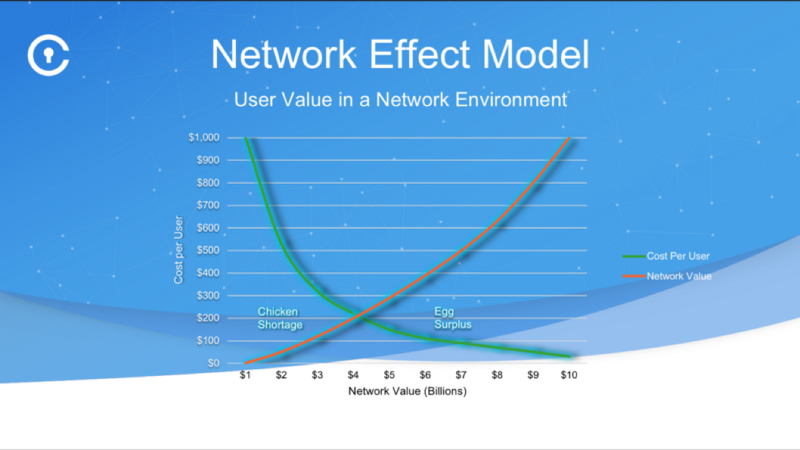

Earlier, in 2016, crypto experts called out that the token adoption will solve the chicken and egg problem for startups, that is, how to build a base of customers/believers in spite of having no product but just an innovative world changing idea? The answer to that was thought to be exploiting “Network Effects — A network effect (also called network externality or demand-side economies of scale) is the positive effect described in economics and business that an additional user of a good or service has on the value of that product to others. When a network effect is present, the value of a product or service increases according to the number of others using it”.

It was presented that token adoption can be built through network value if early believers can be converted into early participants turned investors in the idea business. Below is Vinny Lingham well known graph on the chicken and egg problem solution through Network Effect Model.

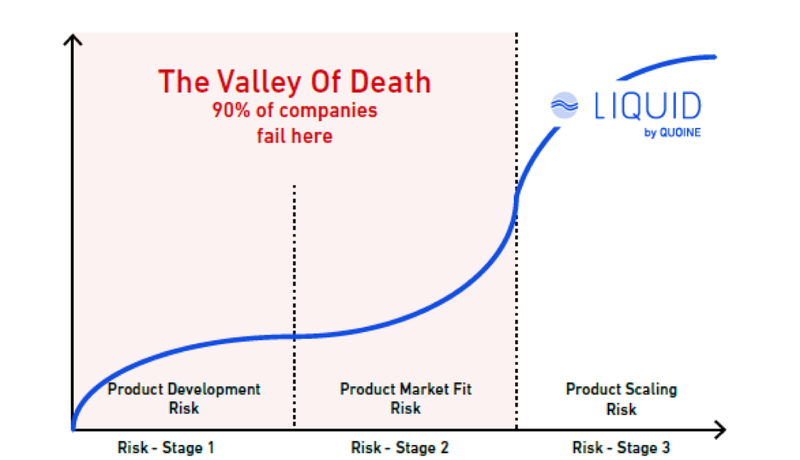

Tokens used for raising funds during an ICO have reached an adoption cycle crisis. Many retail investors who wanted to make quick money from sudden cryptocurrency price rise had pumped money into the ICO market in 2017. But these retail investors have rarely adopted the crypto products for use.

As of now more than 90% of successful and unsuccessful ICO tokens have landed in deadcoins.com.

Top crypto startups have only around 7–8k token adopters, which is actually a very sad number. A few years ago, if your startup had 7–8k users, then you know you have traction problem. Right now the every crypto startup is facing this crisis.

So how did we end up here where the token adoption rate is so low that it is actually hurting the future of mass blockchain adoption.

Ignoring the crypto scams and suddenly rich founders who abandoned their crypto startups after quick gain; many of the legitimate blockchain startups with great products are striving hard to create an ecosystem for successful token adoption. We have heard a lot about network effects but currently these tokens need the magic of consumer adoption effects. So what could be the possible reasons?

WHY THE NETWORK EFFECT DID NOT SOLVE THE TOKEN ADOPTION PROBLEM.

1. If your product or platform is not sticky: There is a recent article by MIT Sloan Professor @Catherine Tucker https://hbr.org/2018/06/why-network-effects-matter-less-than-they-used-to which states that “network effects only really work as a source of competitive advantage if your product is also “sticky.” Scale will not bring future competitive advantage through network effects if your customers can all leave tomorrow.”

2. Not solving any real problem: If you are NOT SOLVING any real world problem or creating any new marketplace or changing the market behavior then one needs to really look into the use cases of these crypto businesses. I have heard pitches of crypto Uber, crypto air bnb…etc..I’m not sure if adding crypto to the already billion dollar existing businesses are solving any compelling problems.

3. People are creature of habits: Adding an additional feature with token economics to the existing legacy product or platform will not translate into huge customer base. One can make some noise that you are bringing down market giants and can attract the FOMO in bull market initially helping in raising millions in few seconds for your ICO, but how many customers would have really made the transition from those legacy system. People are creature of habits and “consumers’ existing habits are a key driver of resistance to new product use” — Habit slips: when consumers unintentionally resist new products.

SO THE QUESTION IS HOW CAN WE INCREASE TOKEN ADOPTION?

Creating an environment where token adoption and usage is easy and consumer friendly is not the starting point. Building a community for the product that truly highlights the solution of the real world compelling problem is as important as working hard on those customer service deliveries and then going through every use case for problem solution and successful adoption. Some of the answers to this question of token adoption lies in the traditional startup building method that every successful founder has utilized and differentiated in their competitive analysis to build a loyal and scalable consumer base.

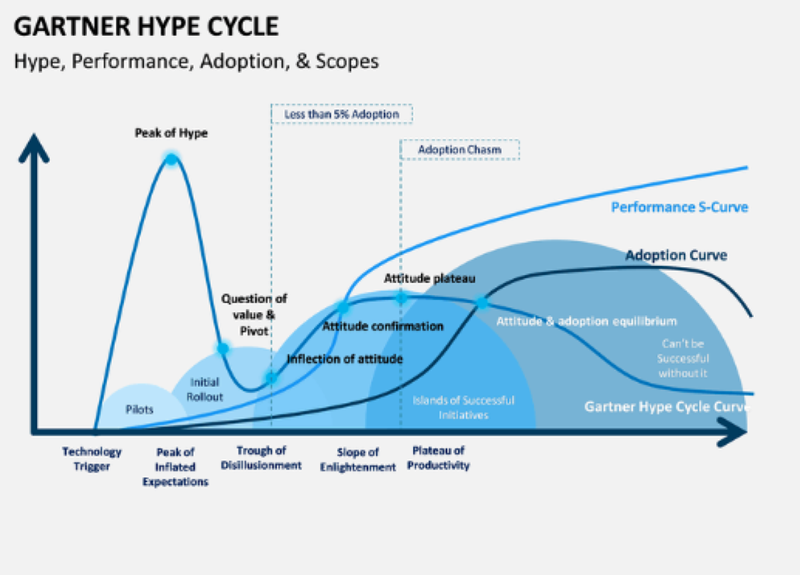

BLOCKCHAIN TECHNOLOGY THROUGH GARTNER HYPE CYCLE

The maturity and adoption phase of the Gartner Hype Cycle provides insight into how new technology can solving real business problems and evolve through various use cases. Among the various phases of the Hype Cycle, we are currently entering the

“trough of disillusionment” phase in Blockchain — when excitement wanes as some of the projects have failed to deliver, the adoption here is less than 5% (graph). “Investments continue only if the surviving projects improve their products to the satisfaction of early adopters.” We are looking at the third generation blockchain products how they can help to overcome the adoption chasm.

The steep entry barrier for common people trying to access crypto in exchanges and the esoteric nature of the blockchain technology reminds us of the early days of computer in 1980s when one needed to know DOS commands and various command line interfaces to interact with the computer. Things have changed with arrival of graphical user interfaces. Manuals for computer guides (if you want to read one here) issued are funny now and things of past. One does not need to provide such manuals to their granny or 2-3 year old child on how to use a computer or iphone. Blockchain needs to go through similar technological user advancement process to onboard more non-crypto savvy consumers. Till then, we need to focus how to decode these complexities and inconveniences whether it is remembering long private keys or the lack of accountability on stolen keys.

BLOCKCHAIN IS NOT THE SOLUTION FOR EVERYTHING!

In a hyped-up bull market, the technology triggers new entrants to promote blockchain as a solution to everything.

Irresponsible entrepreneurship and undisciplined investment are bad behaviors. Such behaviors deliberately manipulate the market and causes distortion in the market to the detriment of everyone. “Market analysts get bad or distorted data that don’t impart understanding of the real underlying market dynamics. Blockchain companies that would have made the best use of funds can go unfunded, sophisticated investors lose money, naive/retail investors lose everything.”

Bitcoin was hatched as an antidote to the 2007 financial crisis. The idea was to protect the people from an unfair system whether it is the government or the financial system “because they work in favor of those who are “too big to fail”, at the expense of those who are “too small to care about.” ” — as said by Ray Dillinger (who worked with Satoshi during early development of Bitcoin- Read the full interview here)

From that decentralized movement to many more centralized promotional campaigns and to commercial enterprise interests and some blockchain implementations, tokenization has come a long way. The new fundraising protocol has truly decentralized the way we raise money, but we can not slap blockchain to every project to get funded unless there is a well-researched real world use case solution that can not be solved through enriched database or simple digital ledger implementation. It will take time and collective innovation to build token adoption, till then let’s focus on compelling and viable use cases research based blockchain solution.

NOTE: This article should not be considered financial or legal advice and is the opinion of the author.

SPORTVEST VC FUND

For more information on the SportVEST Private-Sale, contact us at: hello@sportvest.io or visit our website at: sportvest.io. Don’t forget to join us on Telegram and follow us on Twitter.

Comments