How does someone earn $61 million dollars over 16 years end up having only $3,000 in the bank?

It happens to nearly everyone who gets rich quickly but doesn't learn the wealth mentality. It happened to former NBA player Joe Smith.

Smith began his professional basketball career with the Golden State Warriors when he was the #1 draft pick back in 1995.

When asked what were his biggest mistakes he said he didn't account for taxes, which could amount to half of his contract amount.

His second mistake was that he wasn't careful with what he bought. Every time he was traded to a new city (which was 12 times) he purchased a house. When it came time to sell his old house, he would always lose money on the sale. He did say that he only financed one house, the rest he paid cash for.

It wasn't just houses, he says he had quite a bit of jewelry, oh and cars. Lots of cars. The list of cars he owned would rival any Arab sheik.

- Corvette

- Mercedes 500sl

- Mercedes 600s Coupe

- 2 Range Rovers

- Bentley

- Another Mercedes

- Panamera Porsche

All these cars were mentioned in a brief trailer for a new show, called “Back In The Game,” in which A-Rod helps struggling sports stars with their finances.

Let's hope A-Rod helped the guy. I couldn't imagine what it would be like to have had so much and then lost it all.

Income For Life

But he only has himself to blame. Where he is now is a direct result of all of his past choices. He could have learned how to properly invest. Investments that could now be supporting him. Let's do some quick math.

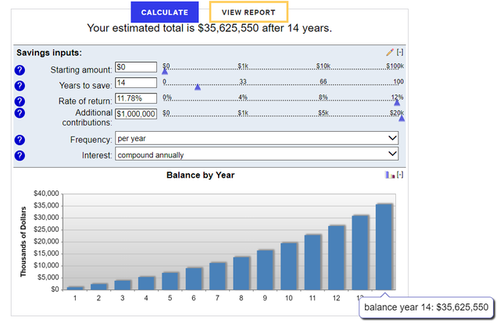

Say out of his $61 million he paid 50% to taxes. Let's make that $30 million. Now if he spent $1 million per year over those 16 years, he would have lived quite a luxurious life and still had $14 million left.

The stock market has had an average return of 11.78% since 1995. If he invested that $14 million in an index fund at a rate of $1 million per year for the next 14 years he would have had $35.6 million dollars.

Using the 4% rule, which states you can withdraw 4% of your investments every year and never run out of money, he would be able to live off of $1,424,000 per year! The 4% is the long-term safe growth rate of stocks + dividends. Meaning that your investments will grow that much every year and you can “harvest” it to live off of without drawing down the principle.

That means he would have lived off $1 million per year while working, but when he retired he would have even more money to play with! And this money would always be there, forever!

That is the power of wealth building. Do you want the fancy cars now or do you want to build a money machine that will earn you money without any more work from you? Stuff or income for life?

To me, the choice is obvious.

Because a little sacrifice now will enable you to live the life of your dreams later.

But some people come from a background where financial literacy is non-existent. He might not have even known that the income for life strategy that I mentioned here was something you could do.

Fortunately, the NBA has begun to require that their new players attend a financial literacy course. This might just be the spark of knowledge that will save a few of these guys from a future in which they lose it all.

Check out the video here:

Comments