I love the NFL and the impact it has on the community. You walk down any street in America and there are kids throwing around a football on every block. I can almost guarantee you that there are more people watching football on Sunday then there are people going to church. The NFL has put together a product on the field that is pretty much its own religion for millions nationwide.

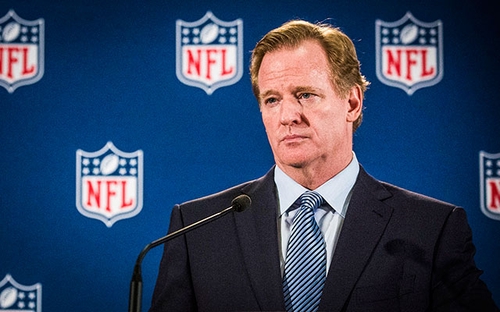

In 2013, the NFL as a whole (all 32 teams) generated $10 billion in revenue and this amount was taxed by the IRS. In 2012, the NFL front office (the office that makes the rules, approves trades, and takes care of the league’s legal formalities) showed revenue of $326 million. This amount is supposedly tax-exempt because the NFL is historically considered a renowned non-profit organization. If you aren’t familiar with the IRS and its tax policy, non-profit organizations are not required to pay any tax since they’re impacting the community in a positive manner without a profit motive. It’s the government’s way of saying thank you for everything you are doing for the people. The NFL has maintained this “non-profit organization” title since 1942 and its front office hasn’t paid a single dime in taxes to the IRS. Recently, this issue was bought to attention by numerous critics primarily located in cities that don’t have a professional football team. As a result, NFL commissioner, Roger Goodell voluntarily chose to step forward and pay taxes to the IRS because of this “distraction”.

It’s fascinating to think that this rule didn’t apply to the NFL for the past 74 years. However, the NFL does a great amount of community service. For example, football players who are representing not only their personal brand, but also the NFL, raised millions of dollars to give back to the people of Houston in the wake of Hurricane Harvey. The NFL and its players also partake in year round community service events such as local food drives, NFL Play 60, Salute to Military, Crucial Catch (effort to beat cancer), and Youth Education Town Grants. Now that the NFL has voluntarily agreed to pay taxes, there’s a catch to it. As long as you are a non-profit organization (which the NFL was up until 2015), the IRS requires the disclosure of every employee’s salary within the organization, including the owner. Roger Goodell’s reported salary in 2013 was $44 million. Here’s the catch, now that the NFL is not “non-profit” anymore since it voluntarily agreed to start paying taxes, Roger Goodell is legally not obligated to disclose his salary.

Regardless of the controversy surrounding Roger Goodell’s salary disclosure, football is always going to be its own religion in America and Sunday mornings just wouldn’t be the same if it wasn’t.

Comments