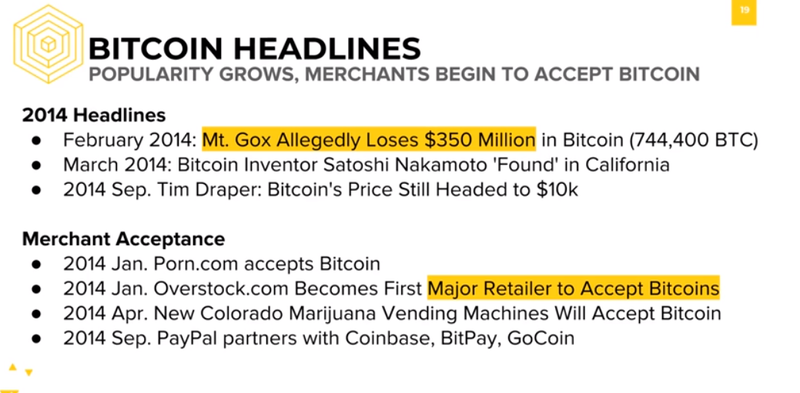

Following years of hacks and bad reputation, Bitcoin finally began to grow in general popularity. Here are some of the big headlines following Mt. Gox’s theft and subsequent declaration of bankruptcy in February 2014:

In March 2014, people thought they had found Bitcoin inventor Satoshi Nakamoto in California, but that was a false alarm. In September 2014, venture capitalist Tim Draper announced his predictions of Bitcoin’s price heading up to $10,000.

For context about his perspective, he was interested in cryptocurrencies since before Bitcoin. In 2003, he met a father in South Korea who bought a virtual sword for his son with fiat money, and was curious ever since.

He also won some bitcoins from the FBI auction of confiscated bitcoins from the Silk Road shutdown. 2014 was also the year when merchants began to accept bitcoin as a form of payment.

In January, Overstock.com became the first major retailer to accept bitcoins. Then, in September, PayPal partnered with Coinbase, BitPay, and GoCoin. Fun fact: Blockchain at Berkeley was previously known as the Bitcoin Association of Berkeley, and in 2014, these headlines were happening every week.

At every club meeting, the 7 members would discuss the latest hack, the latest bankruptcy, and the latest Ponzi scheme. They have grown so much since then, and that just comes to show how much the blockchain space has matured over the years.

A bunch of Bitcoin startups began popping up too.

Wallet companies helped other companies or users handle bitcoin without having to personally join the Bitcoin network. For example, Coinbase is an online exchange that manages wallets and lets users buy and sell bitcoin for fiat currency.

Bitpay allows merchants to accept bitcoin. Blockchain.info is a block explorer that allows users to see individual blocks and transactions in the Bitcoin blockchain in browser, without having to download the entire blockchain themselves. Most importantly, during this time, the term “blockchain” started becoming a buzz word.

This is a graph of Bitcoin prices from 2014-2015, where you can see that first prices shot up immensely, then slowly started to fall. Of course we all know that the price recovered and went back up after this, but this was a huge shock to the community at the time.

There are a few theories as to why Bitcoin burst at this time: One was that investors who had speculated and bought a lot of bitcoin had second thoughts, and began to sell. Especially, Chinese investors had sold because of warnings issued by the Chinese government.

And then of course the market amplified the current trend, so people further dumped because they feared a loss in value.

Comments