The Cypherpunks didn’t get together, design a cryptocurrency, and succeed on their first attempt. Several early attempts at making a true cryptocurrency failed, though they came close. These early failures inspired Bitcoin to adopt some key features that they implemented and learn from their mistakes.

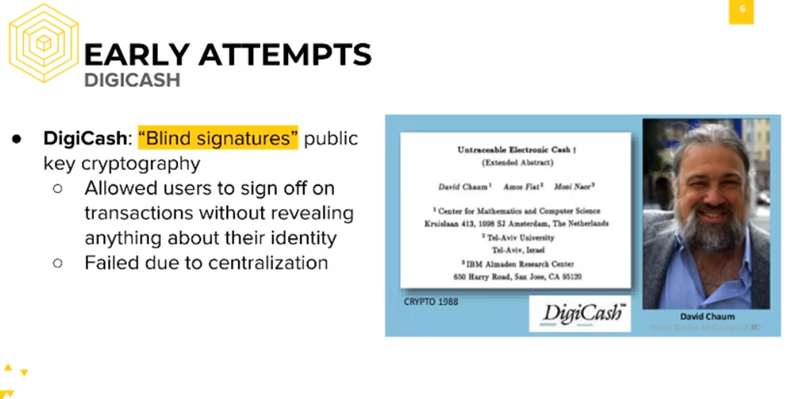

As the existing financial system was one of the greatest threats to individual privacy, cryptographer David Chaum implemented Digicash using the latest advancements in public and private key cryptography. Chaum himself had invented “blind signatures” while studying at UC Berkeley.

Blind signatures allowed users to sign off on transactions without revealing their identity. Digicash promised complete privacy for users conducting online transactions and included a system of cryptographic protocols that prevented banks and governments from tracing personal online payments.

Ironically, however, Digicash failed because of what it feared the most: centralisation. Digicash was hosted by Chaum’s own company, and if his company ever went down, Digicash would also go with it.

And that’s exactly what happened. Chaum’s company DigiCash Inc bore the overwhelming burden of having to validate each and every digital signature in the DigiCash system, which eventually led to bankruptcy in 1998.

Hashcash was originally invented as a mechanism to limit email spam. In order to send out an email, one would have to solve a cryptographic hash puzzle and provide a proof of work.

Only after proving that they have expended computational resources -- with a Hashcash stamp added to the email header -- can someone send out a valid email. Email recipients can then verify emails that they receive are valid, by looking at the email headers for a valid Hashcash stamp.

The idea is that spammers wouldn’t be able to spam emails anymore. It would be too costly, as spammers goals are to send out huge numbers of emails with little cost per message. So by making it computationally expensive to send out email, hashcash disincentivised spammers.

B-money was an early proposal for a cryptocurrency created by Wei Dai. In 1998, Dai published a paper titled “B-money, an anonymous, distributed electronic cash system,” and laid out some core concepts that would later be used to implement Bitcoin and other cryptocurrencies.

Among B-money’s core concepts were that: A proof of work function like Hashcash is used as a means of creating money. Everyone maintains a copy of the database showing who owns what, and work is verified by the community, who all work to update a collective ledger. And transactions are accomplished by collective bookkeeping and authenticated with cryptographic hashes.

Workers are awarded funds for their efforts in creating money through expending computational resources. Contracts and transactions are enforced through the broadcast and signing of transactions with digital signatures.

These ideas from B-money would later influence the development and design philosophy of Bitcoin.

Comments